In an ever-changing economic landscape, investment-linked life insurance plans can be influenced by market fluctuations. However, traditional life insurance offers stability and peace of mind, ensuring that your loved ones are protected no matter the circumstances.

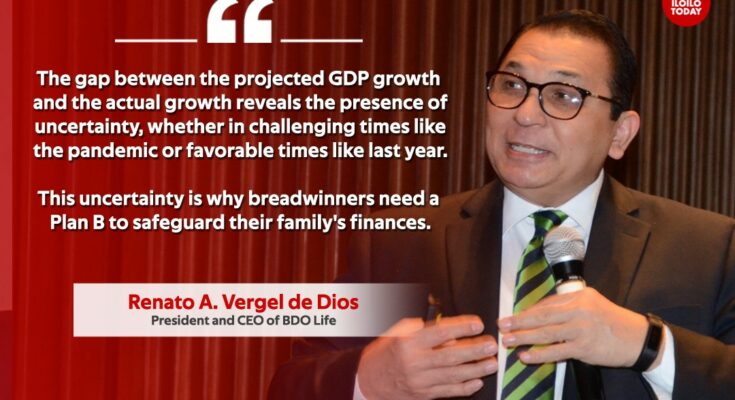

Renato Vergel De Dios, President of BDO Life Assurance Company, Inc. (BDO Life), highlights the company’s commitment to traditional life insurance as an essential “Plan B” for families.

“The gap between the projected GDP growth and the actual growth reveals the presence of uncertainty, whether in challenging times like the pandemic or favorable times like last year. This uncertainty is why breadwinners need a Plan B to safeguard their family’s finances,” the industry veteran said.

Vergel De Dios added, “A family that has recently lost its breadwinner will face greater challenges during economically uncertain times unless adequate provisions for their financial protection have been made. This is what Plan B represents. Considering life’s uncertainties, life insurance protection is the financial instrument that can help mitigate the risks that families face.”

Filipinos can approach a BDO branch and consult a BDO Life Financial Advisor to initiate and plan their Plan B. For those interested in life insurance and who prefer managing their financial planning, BDO Life offers an online tool, Get A Quote (GAQ), enabling them to calculate a personalized insurance plan based on their financial goals and budgets. Explore the simplicity and effectiveness of GAQ at www.bdo.com.ph/bdo-life/get-a-quote.

BDO Life, supported by BDO Unibank, has the largest branch network in the Philippines and provides life insurance plans that address individuals’ protection, health, education, savings, retirement, and estate planning needs.