Scammers are everywhere and use different schemes to dupe the public. Below are some of the most common tactics scammers use to reel in their potential victims either through text, voice call, email, or social media:

- Offer unrealistic rewards. They send a message congratulating you for winning in a raffle or contest you did not join in the first place. If the reward is too good to be true, it probably is.

- Guarantee a high-paying job. Scammers offer salaries unrealistically high for the position they are presenting and the effort required for the job. They also ask for an application fee, which should already be an automatic red flag for any jobseeker.

- Promise low-risk, high return in investments. Much like the way some scammers use too-good-to-be-true rewards as bait, other scammers also use the promise of high returns in an investment scheme with very minimal to no risk. To further add “credence” to this fake offer, scammers use fake investor testimonials, fake endorsements from chief executives of banks or other renowned companies, and even hijack websites of legitimate media outlets to post these fake endorsements or interviews.

- Make threats. Rather than offering unrealistic incentives as a carrot, some scammers impersonating a bank representative use scare tactics to push their potential victims into a rushed decision. They usually do this contacting the potential victims and claiming that they spotted an unauthorized transaction in the latter’s online bank account and that they (scammers) had to lock the account as a result. To “unlock” the account, the potential victims are instructed to click on a link—leading to a fake bank website—and enter their account credentials, which scammers will then use to steal from their victims’ online bank account.

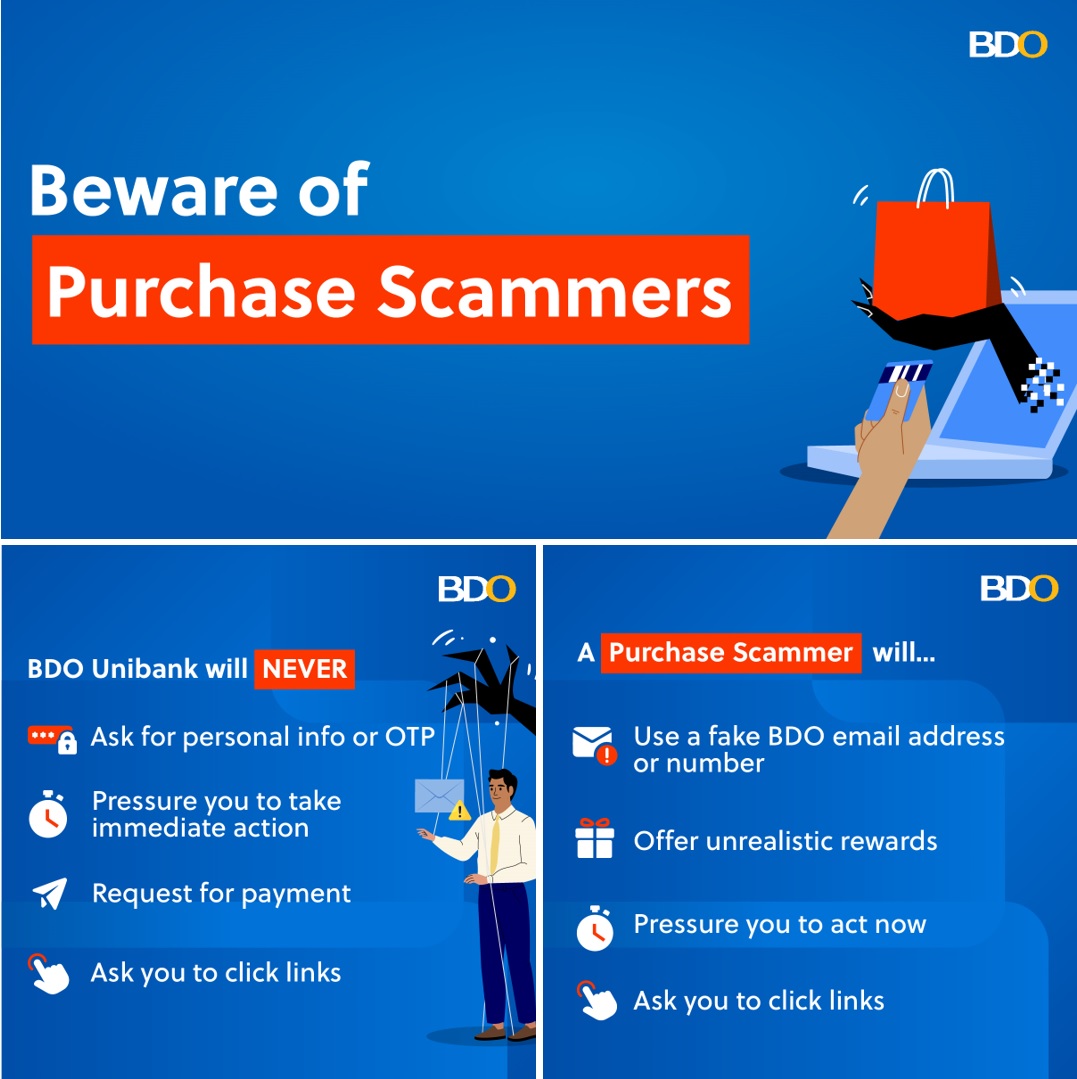

In all these scenarios, these are the common characteristics of this type of scammers:

- They make unrealistic or too good to be true offers.

- They pressure their potential victims to take immediate action.

- They ask for their potential victims’ personal information.

- They ask their potential victims to click on suspicious links.

- They write in strange, grammatically incorrect sentences.

To caution the banking public against scammers and their modus, BDO Unibank stresses that it will never do the following to anyone:

- Ask for personal information or One-Time PIN or OTP;

- Ask to click on links;

- Exert pressure for an immediate action; and

- Request for payments.

To know more about the different types of scam and tips on how to protect one’s online bank account against scammers, BDO reminds the public to visit www.bdo.com.ph. #BDOStopScam