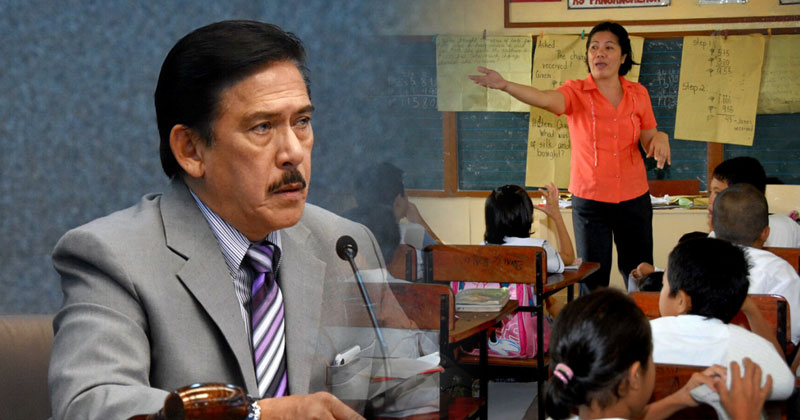

Senate President Vicente Sotto III is now pushing to exempt public school teachers from paying income taxes as a gift to their sacrifices.

Sotto has filed Senate Bill No. 241, otherwise known as an Act Providing Tax Relief to Public School Teachers by Exempting them from Income Taxation, Amending for the Purpose Sections 22 and 24A of the National Internal Revenue Code of 1997, As Amended, which seeks to exempt Teachers I, II and III from paying income tax.

Sotto said he filed the bill because he wanted to improve the economic status of the teachers, who upon entry-level, receive only a little higher than the minimum wage.

By lifting the burden of paying the income tax, Sotto said, teachers are given what they rightfully deserve. He said the measure is a gift for the teachers’ unconditional love and sacrifice in molding the youth to be the future’s leaders.

Likewise, he said, holiday pay, overtime pay, night shift differential and hazard pay received by Teachers I, II and III will not be taxable.

“This bill is in consonance with the Magna Carta for Public School Teachers which aimed to promote and improve the social and economic status of public school teachers, their living and working conditions, their terms of employment and career prospects,” Sotto said.

Sotto said senators of the 18th Congress will work to increase the salary of public school teachers so they can be at par with their counterparts from neighboring Asian countries.

“We recognize the inevitable fact that our teachers play a crucial and significant role. The future of our youth and nation lies in the nurturing hands of our teachers. We consider them as our modern-day heroes,” Sotto said. (via Senate)