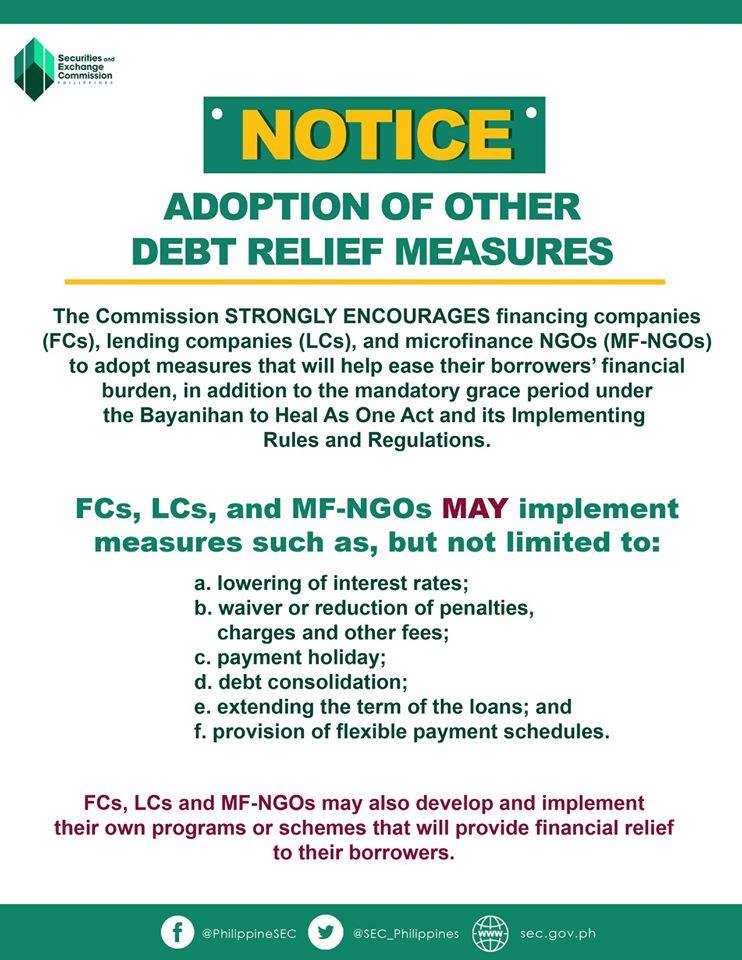

The Securities and Exchange Commission (SEC) is again calling on lending companies, financing companies and microfinance non-government organizations (NGOs) to provide relief to their borrowers while the economy gradually reopens.

In a notice dated June 11, the Commission “strongly encouraged” lending companies, financing companies and microfinance NGOs to implement debt relief measures such as lowering of interest rates, waiver or reduction of penalties, charges and other fees, payment holiday, debt consolidation, extension of loan terms, and provision of flexible payment schedules.

Lenders may likewise develop and implement their own programs or schemes that will provide relief to their borrowers, in addition to the mandatory grace period required under Section 4(aa) of Republic Act No. 11469, or the Bayanihan to Heal As One Act, and its Implementing Rules and Regulations (IRR).

Section 4(aa) of the Bayanihan to Heal as One Act empowered the President to implement a minimum 30-day grace period for the payment of all loans. Under the IRR issued in April, all lenders, including those under the supervision of the SEC, shall apply an initial 30-day grace period to all loans with principal and/or interest falling due within the enhanced community quarantine (ECQ) period.

The IRR provided the automatic extension of the grace period should the President extend ECQ period.

Accordingly, all financing companies, lending companies and microfinance NGOs were required to apply the mandatory grace period to all loans with principal and/or interest falling due between 17 March 2020 and 31 May 2020. Aside from providing grace period, all covered institutions were prohibited from imposing interest on interest, fees and other charges to future payments or amortization.

Borrowers were likewise given the option to pay the interest accrued during the grace period on a staggered basis over the remaining life of the loan The SEC earlier reminded financing and lending companies to strictly comply with the Bayanihan to Heal As One Act, its IRR and other applicable laws, rules and regulations, warning that any violation or noncompliance shall be dealt with to the full extent of the law.