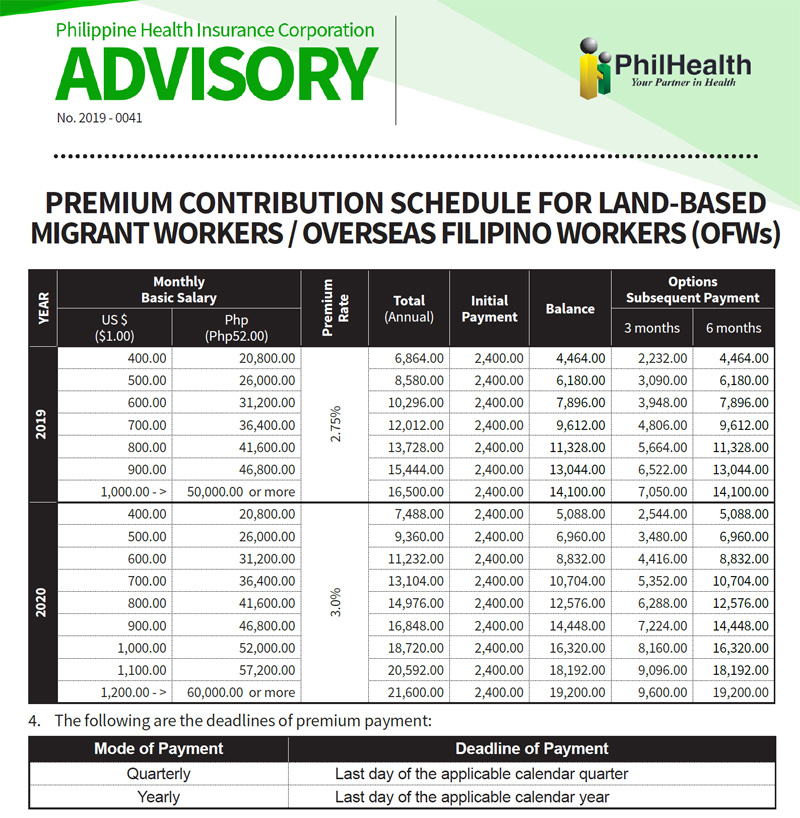

From P2,400 annually, Overseas Filipino Workers (OFWs) must pay Philippine Health Insurance Corporation (PhilHealth) premium contribution of up to P21,600 this 2020.

In the new contribution schedule of PhilHealth which was released in November 2019, OFWs are now categorized as ‘Direct Contributors’ in accordance to the Universal Health Care (UHC) Law of 2019 and its implementing rules and regulations.

[Related Update: Philhealth contribution for OFWs will be up to P29,400 in 2021.]

Direct contributors refer to those who are gainfully employed and bound by an employer-employee relationship. Aside from OFWs, kasambahays, self-earning individuals, and practicing professionals belong to this membership category as well.

“In its PhilHealth Circular No. 2019-0009 published on November 23, 2019, premium rate for Direct Contributors shall still be at 2.75% of their monthly basic salary with an adjusted ceiling of P50,000. In 2020, PhilHealth will increase the rate to 3% and henceforth adjusted to increments of 0.5% every year until it reaches the 5% limit in 2025 as provided for by law. Income floor is fixed at P10,000 during the 5-year period, while salary ceiling will gradually increase by P10,000 each year from P60,000 until it reaches P100,000 in 2025,” Philhealth explained in a statement.

For those earning below the salary floor of P10,000, contributions are computed using the minimum threshold; while those who earn the set ceilings/limits shall pay premiums based on the set ceiling. This policy shall also apply to seafarers.

That means if your basic salary is 10,000 and below, your monthly premium is P300 monthly or P3,600 yearly. But if your salary is P60,000 and up, you will pay P1,800 monthly or P21,600 annually.

Premiums of self-paying members, professional practitioners, and land-based OFWs are computed straight based on their monthly earnings and paid in whole by the member. To ensure accuracy in computation, PhilHealth will require submission of financial records such as latest income tax return received by the Bureau of Internal Revenue, duly-notarized affidavit of income declaration, or overseas employment contract as proof of income. Otherwise, the contribution will be based on the highest computed rate.

Kasambahay Philhealth Contribution 2020

Pursuant to Republic Act 10631 or the Kasambahay Law, employers shall borne the premiums of their domestic helpers in full, except when monthly salary exceeds P5,000 where Kasambahays shall then be deducted of their equal share in the monthly contribution. In cases of ’employed’ Persons with Disability (PWDs) listed in the Department of Health’s PWD registry, their contributions shall be equally divided between their employers and the National Government for their personal share.

The state agency said that the new schedule will help ensure sustainability of the National Health Insurance Fund, guaranteeing that all Filipinos are able to avail of outpatient benefit packages that are currently being finalized, as well as immediate eligibility to benefits during confinement.

“Starting November 22, 2019 until such time that a new set of guidelines are issued, all Filipinos including those without the qualifying contributions shall be allowed to avail of the PhilHealth benefits,” PhilHealth President and CEO Ricardo C. Morales announced.

Interest for missed payments

While no one will be denied of PhilHealth coverage due to non-payment of premiums, Morales also clarified that members lacking contributions shall be billed for the unpaid premiums with interests (compounded monthly) and penalties of at least 3% a month for employers, sea-based OFWs, and Kasambahays. On the other hand, self-earning members, professionals and land-based migrant workers shall incur a maximum interest of 1.5% for every month of missed payment. Interests, however, shall only be applied effective applicable month of January 2020.

PhilHealth assured that the adjustments in contributions are sanctioned by law and essential in sustaining and enhancing its benefits and services to its 108 million-strong members and beneficiaries here and abroad. (via Philhealth)

2 Comments on “OFWs to pay up to P21,600 Philhealth contribution this 2020”