Being a millennial is really an interesting stage of one’s life. They are the ones who are enjoying their own money, but at the same time life events such as marriage, having a family, getting an illness, and even retirement starts to loom in the horizon.

They need to set financial goals now, so that they will eventually reap financial freedom and a brighter life ahead for themselves and their loved ones.

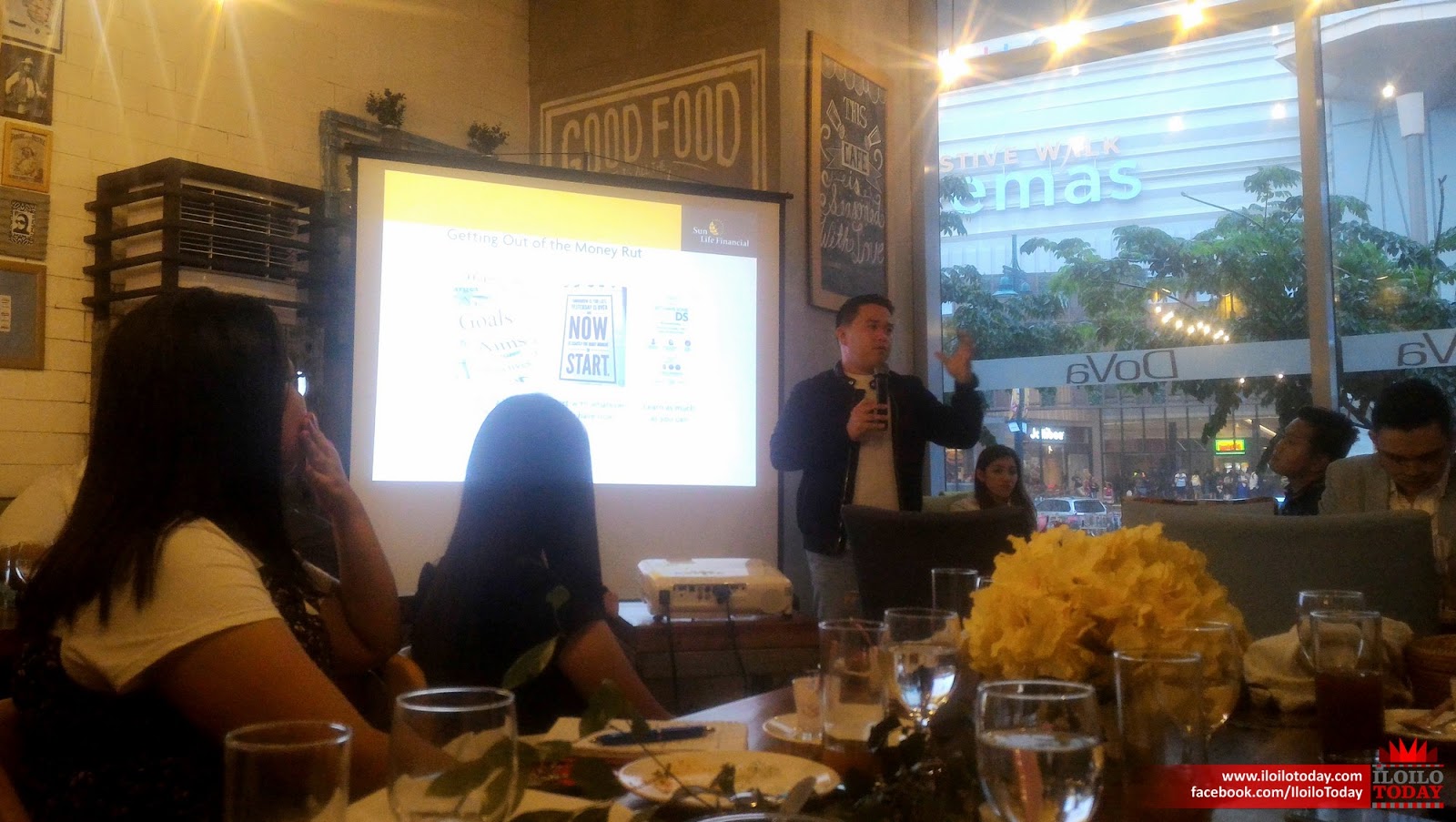

Helping them be financially prepared for the future is the main thrust of the literacy campaign of Sun Life Financial, which had a stop in Iloilo through an intimate talk with Ilonggo millennials held recently at Dova Brunch Cafe in Iloilo Business Park.

Dubbed as Let’s Have Some Funds, the fun and educational program featured two millennials who gave away tips to their fellows in attendance about managing finances and investing for the future.

In her keynote address entitled Money Under 30, young entrepreneur and social media influencer Katrina Loring shared her struggles and successes in putting up and managing several businesses at an early age. Money mistakes such as zero savings, over spending, and credit use, something most millennials commit, were pointed out.

Loring dished out some of the lessons she learned: pay debts, pay bill on time, plan your budget, record your expenses, make savings automatic, and to prepare for rainy days and dreams.

“The art is not in making money, but in keeping it,” she concluded.

Michael Gustilo, Visayas Regional Sales Manager of Sun Life Financial, Inc., highlighted the importance of setting financial goals in reaching one’s dreams in his talk FUNding Your Life Goals.

“Having clear dreams and life goals will give you a compelling reason to save and invest rather than spend needlessly,” he emphasized.

Gustilo also discussed some of the ‘money regrets’ of millennials such as excessive spending on wants, starting late on financial management and being dependent on salary as the only source of income.

He admitted having those mistakes early on, but a wise advice from a friend who is a Sun Life Financial Advisor helped him get out of the rut and being wise on handling finances.

“Sit down, evaluate your finances and spending habits, and identify opportunities or tools that will help you maximize for a bigger goal in the future,” he recalled.

Sun Life Financial has been helping Filipino millennials embrace the brighter life through their financial literacy campaign and wide spectrum of products that include Life Insurance, Accidental Insurance, and Mutual Funds.

Millennials may avail of their insurance plans that’s tailored based on one’s age, gender, and lifestyle. For investment options, Sun Life offers mutual funds products which can be had for an initial investment of only P5,000.

Sun Life financial advisors are not just product-pushers, hard-selling insurance policies down your throat. They are trained to give professional financial advice, to do financial planning before they even prescribe a product. They are professionals, having completed Sun Life Training Course and pass a licensure exam mandated by the Insurance Commission.

Sun Life Financial is the no. 1 insurance company in the Philippines for 7 straight years, serving Filipinos for over 123 years now.