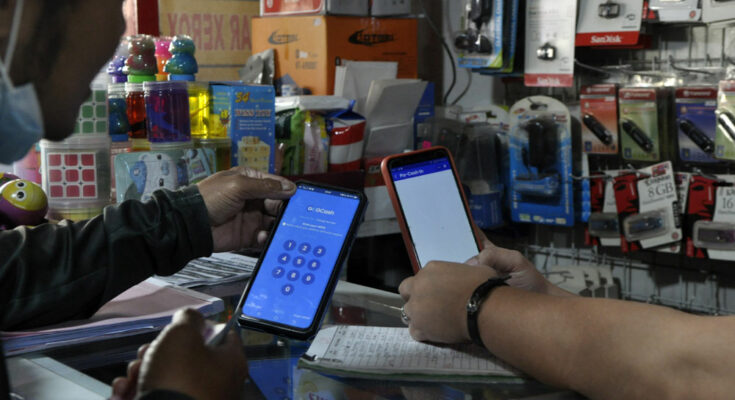

Entrepreneurs in the Philippines will soon gain a new platform for growth with the launch of GCash Pro, an all-in-one business portal that provides merchants greater value, more choices, and an increased flexibility to manage their business finances.

Providing a platform to support micro, small, and medium enterprises (MSME) is crucial for a sustainable economy as they comprise 99.5% of business in the Philippines. Majority of MSMEs (59%) have already adopted digitized processes, but the experience still remains to be fragmented, with several disjointed platforms and providers for various services, making it an overwhelming and confusing experience for business owners.

Aside from offering cashless payment acceptance solutions, GCash Pro will enable MSMEs to oversee their company’s expense management, disbursements, logistics, and even access curated government services.

With GCash Pro, small enterprises will soon be able to access business loans and insurance, as well as avail of ad tech solutions for a smart and efficient way of connecting to their customers.

“In line with the company’s vision of ‘Finance for All’, GCash supports and champions MSMEs. With GCash Pro, we aim to provide them with a solid digital platform that enables their business to achieve sustainable growth. Through the portal, entrepreneurs can also be empowered to transform their business,” said Martha Sazon, president and CEO of GCash.

“With GCash Pro, MSMEs can future-proof their businesses through different digital solutions specifically developed and targeted for their needs. They can offer more safe payment options to their customers, track transactions seamlessly, manage employee payouts securely and conveniently, attract the right customers for optimal conversion, and more,” said Ren-Ren Reyes, GCash chief commercial officer.

As GCash Pro moves closer to its official launch date in the first quarter of 2023, MSMEs can also look forward to more customized services and features that will make it easier for them to monitor their stores, inventories, and transactions.

Four out of five adults in the Philippines now use GCash for its wide variety of features, such as GInvest for investments, GSave for a savings account, GCredit for a credit line, GInsure for insurance, and GLife for.

The GCash app is available for free on the Google Play Store, App Store, and HuaweiApp Gallery.

For more information, visit www.gcash.com.