All online sellers and those conducting business through electronic means must register with Bureau of Internal Revenue (BIR) and declare their past transactions subject to pertinent taxes.

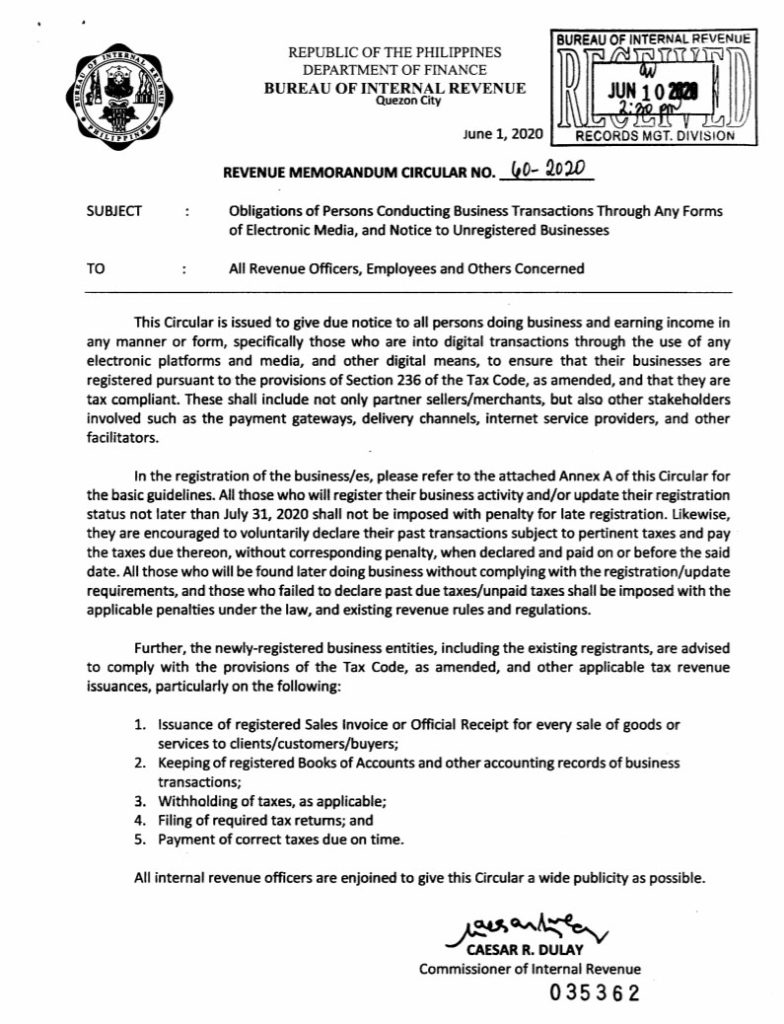

BIR issued Revenue Memorandum Circular No. 60-2020 dated June 1, with subject “Obligations of Persons Conducting Business Transactions Through Any Forms of Electronic Media, and Notice to Unregistered Businesses.”

Signed by BIR Commissioner Ceasar Dulay, the “Circular is issued to give due notice to all persons doing business and earning income in any manner or form, specifically those who are into digital transactions through the use of any electronic platforms and media, and other digital means, to ensure that their businesses are registered pursuant to the provisions of Section 236 of the Tax Code, as amended, and that they are tax compliant.”

The Memorandum covers not only partner sellers/merchants, but also other stakeholders involved such as the payment gateways, delivery channels, Internet service providers, and other facilitators.”

BIR encouraged those who will register to do it not later than July 31, 2020 to avoid penalty for late registration. Likewise, they are encouraged to voluntarily declare their past transactions subject to pertinent taxes and pay the taxes due thereon, without corresponding penalty, when declared and paid on or before the said date.

All those who will be found later doing business without complying with the registration/update requirements, and those who failed to declare past due taxes/unpaid taxes shall be imposed with the applicable penalties under the law, and existing revenue rules and regulations.

Further, the newly-registered business entities, including the existing registrants, are advised to comply with the provisions of the Tax Code, as amended, and other applicable tax revenue issuances, particularly on the following:

1. Issuance of registered Sales Invoice or Official Receipt for every sale of goods or services to clients/customers/buyers;

2. Keeping of registered Books of Accounts and other accounting records of business transactions; 3. Withholding of taxes, as applicable;

4. Filing of required tax returns; and

5. Payment of correct taxes due on time.

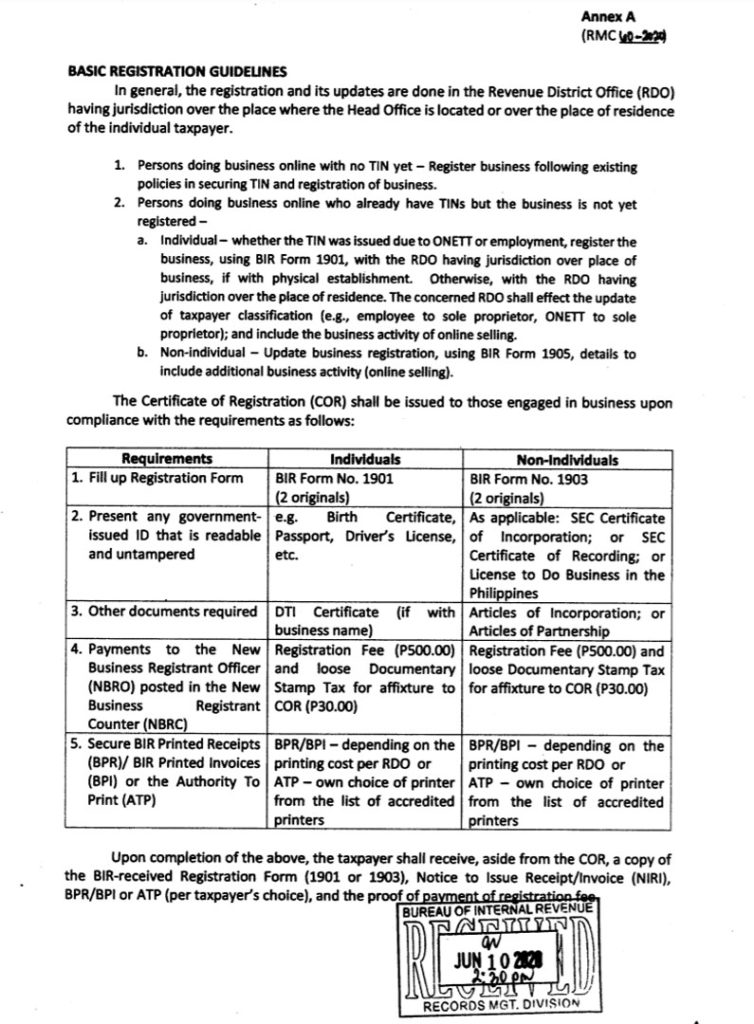

The Memorandum has also attached the basic guidelines which will assist those who will comply with the registration process.